Santa Clara Sales Tax 2025. The santa clara, utah sales tax is 6.35%, consisting of 4.70% utah state sales tax and 1.65% santa clara local sales taxes.the local sales tax consists of a 0.10% county. The sales tax rate in santa clara is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax.

For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The current sales tax rate in santa clara county, ca is 9.88%.

The average cumulative sales tax rate in santa clara, california is 9.2% with a range that spans from 9.13% to 9.38%.

The sales tax rate in santa clara is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax.

Measure A County of Santa Clara Sales Tax YouTube, The latest sales tax rate for santa clara, ca. Santa clara collects a 2.5% local sales tax, the maximum local sales tax allowed under new mexico.

Shadow poll tests new sales tax in Santa Clara County San José Spotlight, Santa clara county, ca sales tax rate. This rate includes any state, county, city, and local sales taxes.

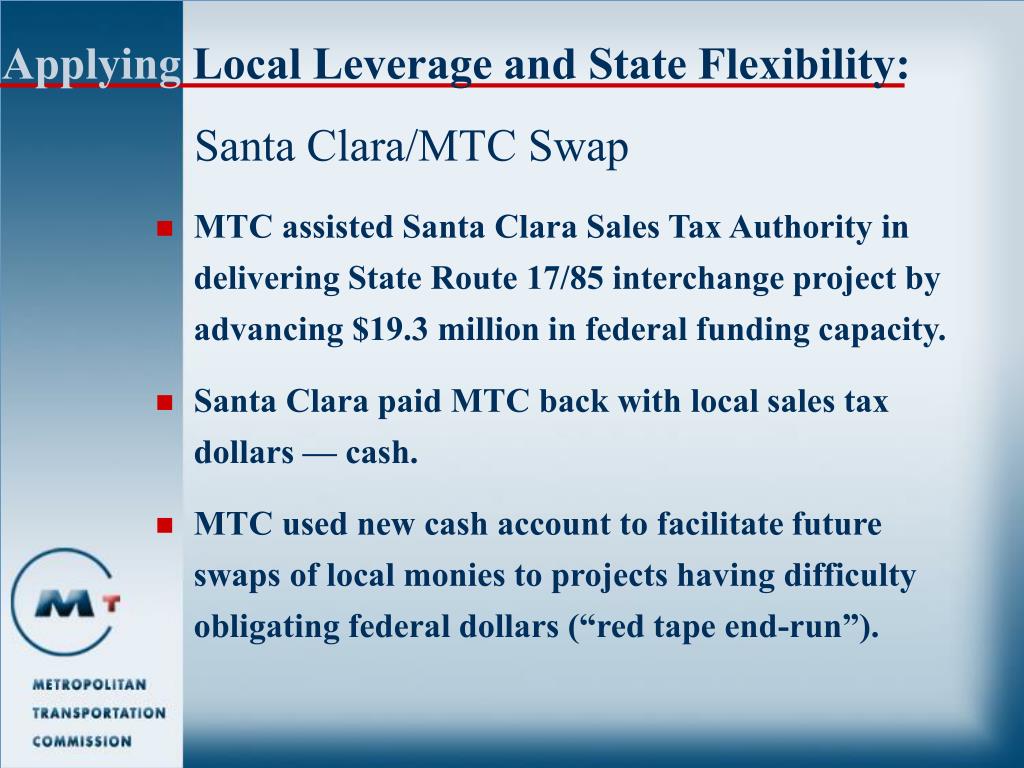

PPT Opportunity Knocks PowerPoint Presentation, free download ID, These rates may be outdated. There is no applicable city tax.

Santa Clara County to vote on sales tax increase for transportation, The average cumulative sales tax rate in santa clara county, california is 9.3% with a range that spans from 9.13% to 9.38%. Santa clara county, located in the center of silicon valley, has sales tax rates ranging from 9.125% to 9.875%.

Santa Clara Sales Tax cloudshareinfo, View sales history, tax history, home value. Click for sales tax rates, santa clara county sales tax calculator, and printable sales tax table from sales.

Caltrain explores SF, San Mateo, Santa Clara sales tax to fund, ☛ santa clara (ca) sales tax calculator online. The santa clara county sales tax calculator allows you to calculate the cost of a product (s) or service (s) in santa clara county, california inclusive or exclusive of sales tax.

City of Santa Clara Tax Increase NAIOP Silicon Valley, The 9.125% sales tax rate in santa clara consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.875% special tax. The santa clara county sales tax calculator allows you to calculate the cost of a product (s) or service (s) in santa clara county, california inclusive or exclusive of sales tax.

Santa Clara County approves Caltrain sales tax measure LaptrinhX / News, The california sales tax rate is currently %. 4 beds, 2 baths, 1764 sq.

Find the Best Tax Preparation Services in Santa Clara, CA, The average cumulative sales tax rate in santa clara county, california is 9.3% with a range that spans from 9.13% to 9.38%. The santa clara county sales tax calculator allows you to calculate the cost of a product (s) or service (s) in santa clara county, california inclusive or exclusive of sales tax.

Santa Clara County proposes 'regressive' sales tax hike for COVID19, Santa clara county, ca sales tax rate. The combined rate used in this calculator (9.125%) is the result of the california state rate (6%), the 95052's.